Home Fixes

Updating Your Homeowner Insurance After a Renovation

If you’re planning on starting a home remodeling project, it’s important to consider how your homeowners insurance can change. Installing features that reduce the overall risk of damage to your home can lower your insurance rates, while increasing the rebuilding cost and associated risks may raise your insurance premiums.

Because home remodeling is a large financial investment it’s important to ensure you have the correct insurance coverage to lower the risk of financial hardship due to unexpected expenses. Read on for more information on how renovations can affect your homeowner’s insurance.

Renovations That Raise Your Insurance Rate

If you’re planning to make major structural changes to your home that increase its square footage and value, like adding rooms, you can expect to see a rise in your home insurance rate. Making upgrades that increase the value of your personal property like kitchen remodels or adding luxury fixtures will require you to increase your policy limits so you don’t exceed your personal property coverage.

Smaller projects like installing sump pumps, adding residential solar panels, or replacing your home’s siding could increase your rate, depending on the materials you use. Plus, any high-liability features like a swimming pool will require additional coverage to protect against liability costs.

Renovations That Lower Your Insurance Rate

Smaller renovation projects like minor landscaping or replacing carpets will not affect your current insurance policy. Typically, renovation projects that make your home safer and more energy efficient will decrease your insurance rates. Upgrades like new HVAC, wiring, and sprinklers can help lower your risk for fires and/or electrical damage, while new plumbing hardware may reduce your risk of water damage.

Replacing your roof may also save you money on your homeowners insurance as a new roof can help your home defend against covered damages. Homeowners who live in states with extreme weather conditions like hurricanes or hail could even see a larger rate decrease if they implement additional safety measures like impact-resistant shingles or hurricane straps.

Updating Insurance After Your Renovation

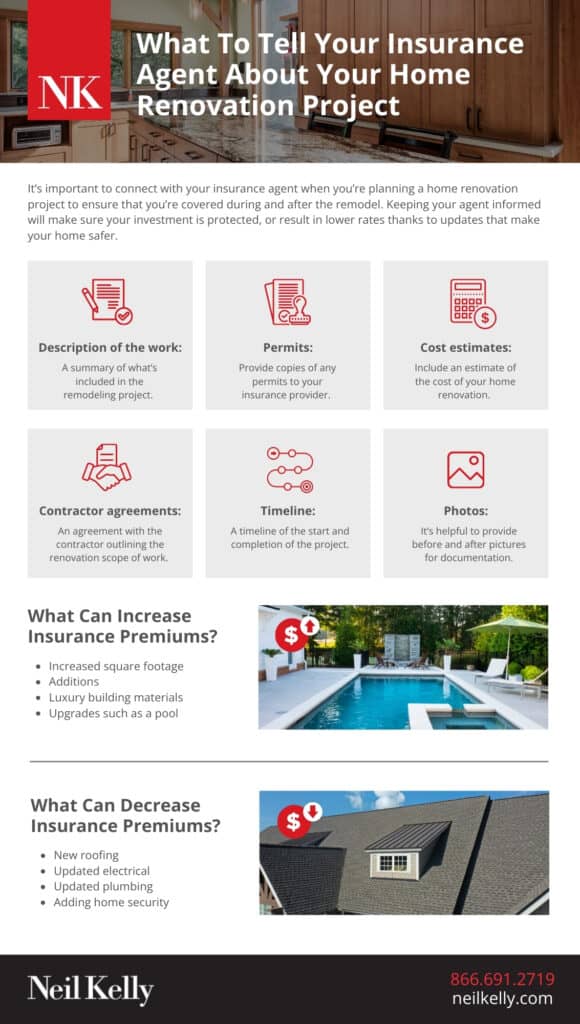

It’s important to connect with your insurance agent before, during, and after your home renovation to make sure you’re covered, especially if you’re doing major renovations that can significantly impact your existing insurance coverage, or render it void. Plus, if you don’t keep your insurance up-to-date, they won’t pay for repair or replacement costs for a covered loss.

It’s helpful to keep receipts, contracts, and even before-and-after pictures to share with your insurance agent. Remember that following a renovation, your home will cost more to build from scratch than it did before, so it’s important to protect your investment. Providing data for your insurance company will help them more accurately determine the value of your home while updating your insurance.

Download Our Guide: What To Tell Your Insurance Agent About Your Home Renovation Project

Choose Neil Kelly for Your Home Remodeling Project

Most homeowner insurance companies will not cover damages made by your contractor during renovations. This is why hiring reputable contractors with liability and workers’ compensation insurance is crucial.

At Neil Kelly, we handle your home remodel with the utmost care and craftsmanship, accompanied by our industry-leading 5-year workmanship warranty on all home remodeling projects.

Schedule a complimentary consultation for your residential remodeling project today.